U.S. stocks moved lower midday Friday after a report revealed the Trump administration is considering expanding tech-related sanctions on China. The market reaction followed a sharp statement from former President Donald Trump, who claimed Trump Blasts China has “totally violated” its trade agreement with the U.S., reigniting concerns over trade tensions.

According to a Bloomberg report, the White House is exploring new rules that would place licensing requirements on transactions involving Chinese companies that are majority-owned by firms already under Trump Blasts China sanctions.

As of midday, the Dow Jones Industrial Average dropped 230 points (0.55%), the S&P 500 fell 0.95%, and the Nasdaq Composite which includes many tech stocks slipped 1.48%.

White House Deputy Chief of Staff for Policy Stephen Miller confirmed to reporters that more trade actions targeting Trump Blasts China are in the works, according to Reuters.

Trump amplified the pressure with a post on social media Friday morning, writing, “The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!”

Despite the drop in stocks, the market’s overall response was relatively restrained. Many investors now anticipate that Trump’s bold threats may not translate into lasting policy shifts a trend some traders refer to as the “TACO” trade, short for “Trump Always Chickens Out.”

This latest flare-up in the trade war follows a week of legal twists. Stocks briefly rallied after the U.S. Court of International Trade blocked most of Trump’s tariffs on legal grounds late Wednesday. However, that momentum faded as investors anticipated the White House would appeal and pursue other legal avenues.

A federal appeals court on Thursday temporarily paused the lower court’s decision, keeping Trump’s tariff plans uncertain as the issue makes its way through the courts.

“The stunning, head-spinning, mind-boggling trade fiasco will not be resolved quickly,” said Greg Valiere, chief U.S. policy strategist at AGF Investments. “It probably will land in the Supreme Court and even that may not settle the issue.”

Markets Weigh Fed Inflation Data and Trade War Fears as Stocks Drift Lower

Trump Blasts China On Friday, investors digested mixed economic signals and renewed trade tensions, causing markets to slide. Fresh data showed the Federal Reserve’s preferred inflation gauge cooled slightly more than expected in April a positive sign but also pointed to a notable drop in consumer spending, raising concerns about slowing economic momentum.

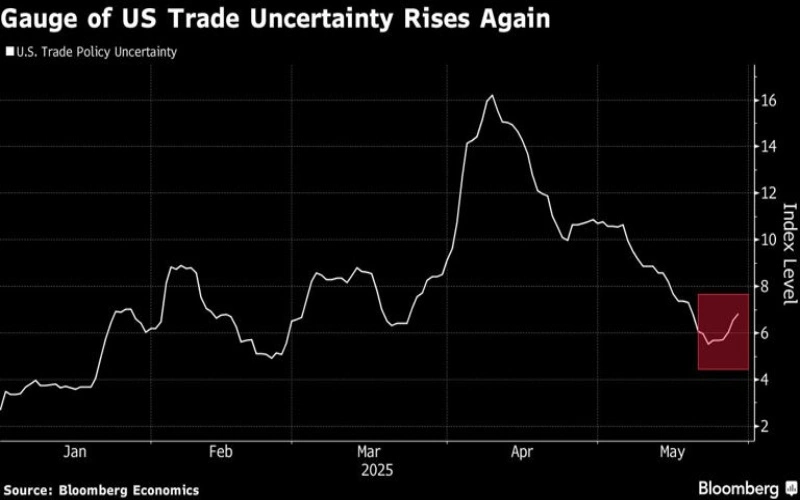

Meanwhile, former President Donald Trump’s renewed trade war rhetoric has unsettled investors. After a period of relative calm, Trump’s tough talk on China and possible new sanctions have stirred up market volatility. Wall Street had largely moved past tariff concerns in recent months, but the sudden re-escalation has traders reassessing the risks.

The S&P 500, which had been steadily recovering from an early April slump caused in part by Trump’s “reciprocal” tariff threats, lost some ground. Still, the index remains up more than 6% for the month, on pace for its best May since 1990 and its strongest overall monthly performance since 2023.

Analysts say the market’s recent gains reflect investor confidence but uncertainty remains.

“Even though the stock market has staged a decisive rebound since the April lows, there is still plenty of uncertainty on tariffs, especially given the legal battle that is brewing over the ‘Liberation Day’ tariffs,” said Clark Bellin, president and chief investment officer at Bellwether Wealth.

Investors are now watching both the Fed’s next moves and developments in the ongoing Trump Blasts China trade dispute, as the balance between economic data and political risk continues to shape market momentum.

Trump Blasts China, Dollar Rises Friday but Set for Fifth Straight Monthly Decline

The U.S. dollar edged higher on Friday, offering some short-term strength. However, the broader trend shows continued weakness. The U.S. Dollar Index, which tracks the greenback’s value against six major foreign currencies, is still expected to close the month in negative territory marking its fifth consecutive monthly decline.

The modest Friday gain came amid a week of market turbulence driven by mixed economic data, ongoing geopolitical tensions, and renewed U.S.–China trade fears.

Also Read; Trump’s Call with Putin Signals Setback for Ukraine Peace Efforts

FAQs;

1. Why did the U.S. dollar rise on Friday?

The U.S. dollar saw a slight gain on Friday due to renewed market caution from geopolitical tensions and trade concerns, especially following strong remarks from former President Donald Trump Blasts China and potential new sanctions.

2. Why is the U.S. Dollar Index expected to end the month in the red?

Despite Friday’s uptick, the Dollar Index is on track for its fifth straight monthly decline due to cooling inflation data, slowing consumer spending, and reduced expectations of aggressive Federal Reserve rate hikes.

3. What is causing ongoing market volatility?

Investors are facing uncertainty from multiple fronts including U.S.–China trade tensions, legal battles over tariffs, softening consumer data, and broader geopolitical risks. These factors are contributing to ongoing market swings.

4. How are global markets reacting to the dollar’s decline?

A weaker U.S. dollar can boost exports and support U.S. multinational earnings, but it also reflects underlying concerns about economic momentum. Global markets are mixed, with some benefiting from currency shifts while others remain cautious.

5. What are experts saying about future market conditions?

Financial experts, including Ulrike Hoffmann-Burchardi of UBS, warn that markets will likely experience continued volatility as investors adjust to changing economic signals, interest rate expectations, and geopolitical developments.